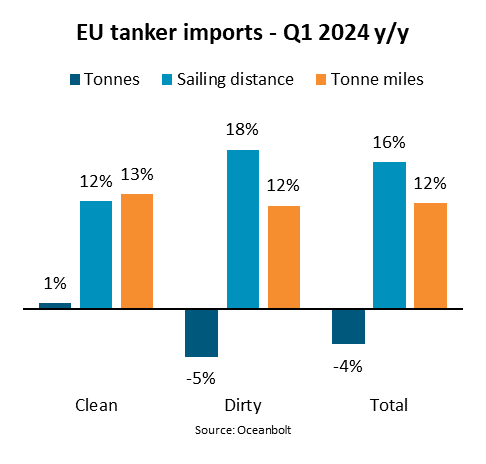

BIMCO Shipping Number of the Week: EU tanker import tonne mile demand up 12% as ships avoid Red Sea area

“In 2023, sanctions on Russian oil exports by the EU caused a major shift in tanker trades and a 10% increase in average sailing distances for EU tanker imports. Now, attacks on ships in the Red Sea area have caused average sailing distances to increase a further 16% and tonne mile demand to increase 12% despite falling volumes,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

During the first quarter of 2024, tanker import volumes to the EU fell 4% year-on-year due to a 1% increase in the clean tanker trade but a 5% fall in the dirty tanker trade. However, as tankers increasingly sail via the Cape of Good Hope due to recent attacks on ships in the Red Sea area, the tanker tonne mile demand increased 12% year-on-year, 13% in the clean tanker trade and 12% in the dirty tanker trade.

“Despite Houthi attacks on ships in the Red Sea, most tankers initially continued to sail via the Red Sea and the Suez Canal. However, ships have increasingly been rerouted via the Cape of Good Hope. Consequently, Suez Canal transits have now fallen 40-50% year-on-year, significantly increasing sailing distances between Asia and Europe,” says Rasmussen.

Average sailing distances in the dirty tanker trade have increased more than in the clean tanker trade because a higher percentage of cargo is destined to Mediterranean ports. The increase in sailing distance to those ports is bigger when sailing via the Cape of Good Hope.

“It was expected that the longer sailing distances and production cuts by OPEC counties could cause EU buyers to favour imports from the Americas over imports from Asia. his has so far not materialised to any great extent, however. In fact, Asian countries’ share of EU dirty tanker imports has risen 24% year-on-year while it has only fallen 6% year-on-year in the clean tanker trade,” Rasmussen says.

So far, VLCCs have been the main beneficiary of the increased tonne miles in the dirty tanker trade while the smaller MRs and LR2s have shared the increased tonne miles in the clean tanker trade. These segments’ fleets will grow only marginally in 2024 and their supply/demand balance must therefore be expected to remain tighter for as long as ships continue to avoid the Suez Canal.

“Even though Europe’s demand for oil has fallen in 2023 and is expected to fall again in 2024, the EU’s importance to tanker trades has increased. Due to trade shifts, EU import tonne miles have risen from 11% of the total tanker trade in the first quarter of 2022 to 14% in the first quarter of 2024 and will remain high as long as ships continue to avoid the Suez Canal. In the medium to long term, the EU is, however, still expected to decarbonise faster than most other regions and tanker trade should fall accordingly,” says Rasmussen.

Source:BIMCO